Topshop, once the crown jewel of British high-street fashion, may be on the verge of a return to physical retail after being limited to online sales since 2021.

The brand, which collapsed in 2020 and was later acquired by Asos, has dropped a series of cryptic social media teasers, fuelling speculation that a major comeback is in the works.

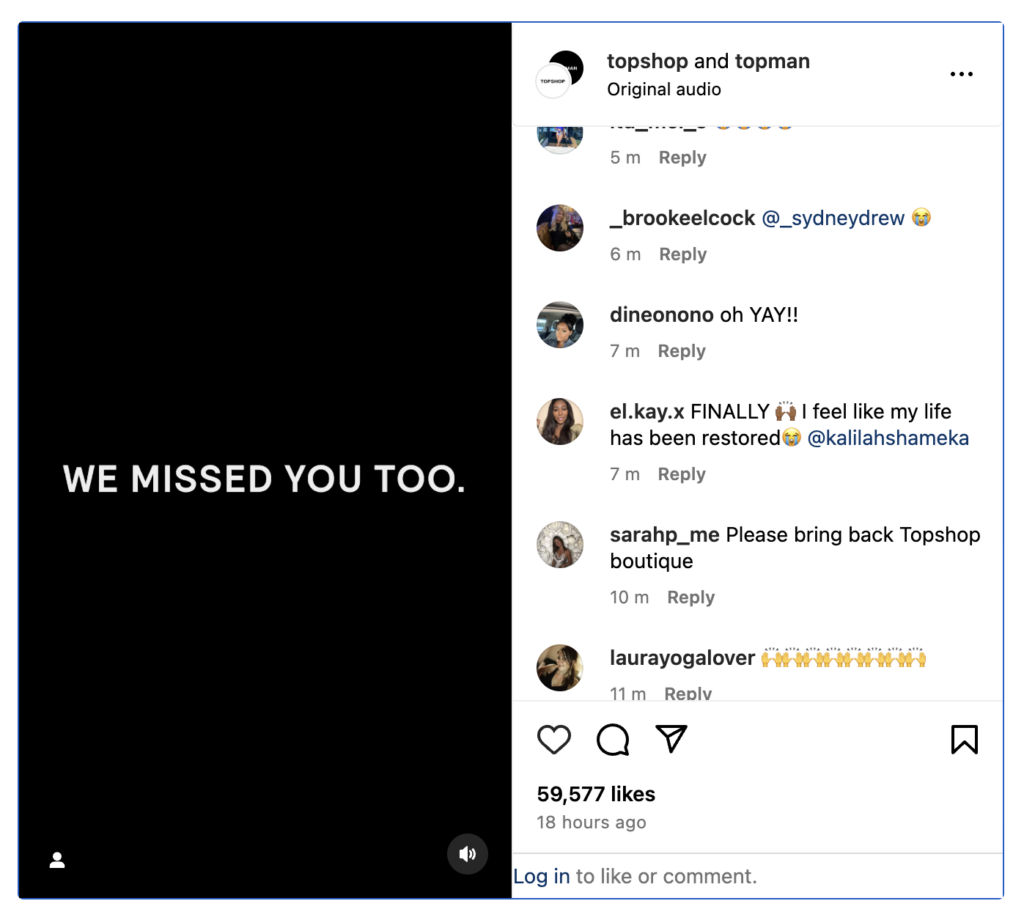

On March 18, Topshop posted a sequence of reels on Instagram, each featuring a single word caption that collectively read: “We’ve been listening.”

The short clips, depicting models standing beneath a Topshop sign, were followed by another caption: “We’ve missed you.”

A nod to Topman, which previously stocked menswear, was also included in the campaign.

Earlier this month, Topshop had posted three teaser videos with the caption: “Watch this space,” hinting at future developments.

The latest announcement follows the appointment of Michelle Wilson as managing director of Topshop and Topman, further strengthening the case for a high-street revival.

Asos’ stake sale in Topshop to Heartland birthed expectations of Topshop’s return

Expectations of a return to brick-and-mortar retail began in September last year when Asos sold a 75% stake in Topshop to Heartland, the investment arm of Danish fashion giant Bestseller, in a £135 million deal.

The transaction, which handed control to billionaire Anders Povlsen, marked a significant shift in the brand’s strategy.

Asos had acquired Topshop for £330 million in 2021 after the collapse of Sir Philip Green’s Arcadia empire.

However, rather than relaunching physical stores, the e-commerce giant integrated the brand into its online marketplace.

Apart from Asos, Topshop products are currently only available in Nordstrom department stores in the US

José Antonio Ramos Calamonte, CEO of Asos, had indicated last year that a dedicated Topshop website would be launched by next summer.

He also suggested that Bestseller’s extensive experience in operating high street stores could play a role in reviving the brand’s physical retail presence.

“We might open stores. We will consider it for sure but we have no specific agreement to open a certain number,” he had said.

Topshop’s legacy and renewed influence

Topshop’s influence on the fashion industry was immense, particularly in the 2000s and early 2010s.

The brand set trends with its collaboration with supermodel Kate Moss, curated in-store experiences, and partnerships with high-end designers such as JW Anderson and Christopher Kane.

Its Oxford Street flagship store was a landmark, drawing shoppers and celebrities alike.

Last year saw nostalgia for the brand surging, particularly with the rise of ‘Britishcore’ aesthetics.

Films like Saltburn, which featured Topshop-era fashion, sparked renewed interest in its signature styles.

According to Vogue, searches for Kate Moss’s Topshop collections rose by 45% month-on-month on resale platform Depop following the film’s release.

Can Topshop thrive in today’s retail landscape?

While the brand’s legacy remains strong, re-entering the physical retail market poses significant challenges.

The fashion industry has evolved dramatically since Topshop’s heyday. Ultra-fast fashion retailers such as Shein and Temu have dominated the affordable clothing sector, while high-street giants like Zara and H&M have strengthened their hold on trend-driven fashion.

“Much has changed since Topshop’s heyday. It’s hard to bring back a brand, especially to a new consumer cohort,” Adam Cochrane, general retail and luxury equity research analyst at Deutsche Bank said in a Vogue Business report last year.

“Topshop should be positioned as the most fashion-forward brand possible with frequent range changes and short lead times. It was not the cheapest option. Fashion credibility has to be the focus rather than just the lowest price. There are too many competitors at the low price point now.”

In the same report, former Topshop managing director Mary Homer expressed optimism. “When I left Topshop in 2017, it was profitable with a turnover of over £1 billion. Could it be revived? I absolutely think it could,” she said.

She acknowledged that the brand’s presence on Asos alone was not enough to sustain its former influence.

“When Asos bought Topshop in 2021, I think it got lost among the other brands [on the platform]. And losing a physical retail presence hasn’t helped either. But there is still a gap in the market, 100 per cent. Teams need to ask what does today’s customer want that they can’t get?”

How can the brand redefine itself?

If Topshop does return to high streets, it must redefine itself in a crowded market.

Experts suggest that the brand should focus on its heritage as a high-street player that successfully merged affordable fashion with high-end collaborations.

During its peak, Topshop was known for offering stylish, high-quality pieces that sat above traditional fast fashion but remained accessible to a broad audience.

Retail analyst Robert Burke pointed out that Topshop was a pioneer in bridging the gap between luxury and high-street fashion.

“Before Topshop, high-low was undiscovered. So you were either a customer of designer brands, or you were a contemporary or fast fashion customer, and that’s what you bought,” he said in the report.

The idea that Barneys — the temple of cool, high luxury fashion — would have Topshop, sent a major message that reverberated through the market. It was available to people of different incomes.

While questions remain about how the brand will position itself, one thing is clear: Topshop still has a strong emotional connection with consumers.

Whether that translates into commercial success depends on how it navigates the challenges of modern retail.

The post Topshop teases a high-street comeback: can it thrive in today’s retail market? appeared first on Invezz